Container imports into the United States surged to a record high in July 2025, with the Port of Los Angeles moving 544,000 TEUs — up 8% from last year. The spike was driven largely by retailers rushing to bring in goods ahead of proposed tariff hikes, with importers aiming to secure stock for the holiday season months earlier than usual.

This change in timing has knock-on effects for food logistics. Perishable goods typically flow in closer to peak demand, but this year’s early shipping push could leave mid-season supply gaps if demand outpaces existing inventory. For importers of frozen and packaged foods, it also raises the challenge of longer storage times, increased cold-chain costs, and potential shelf-life management issues.

Gene Seroka, executive director of the Port of Los Angeles, said that volumes may now taper off for the remainder of the year, as much of the seasonal inventory has already landed. While this provides short-term breathing room for port and transport operators, it also underscores the fragility of supply chains that are highly sensitive to policy uncertainty.

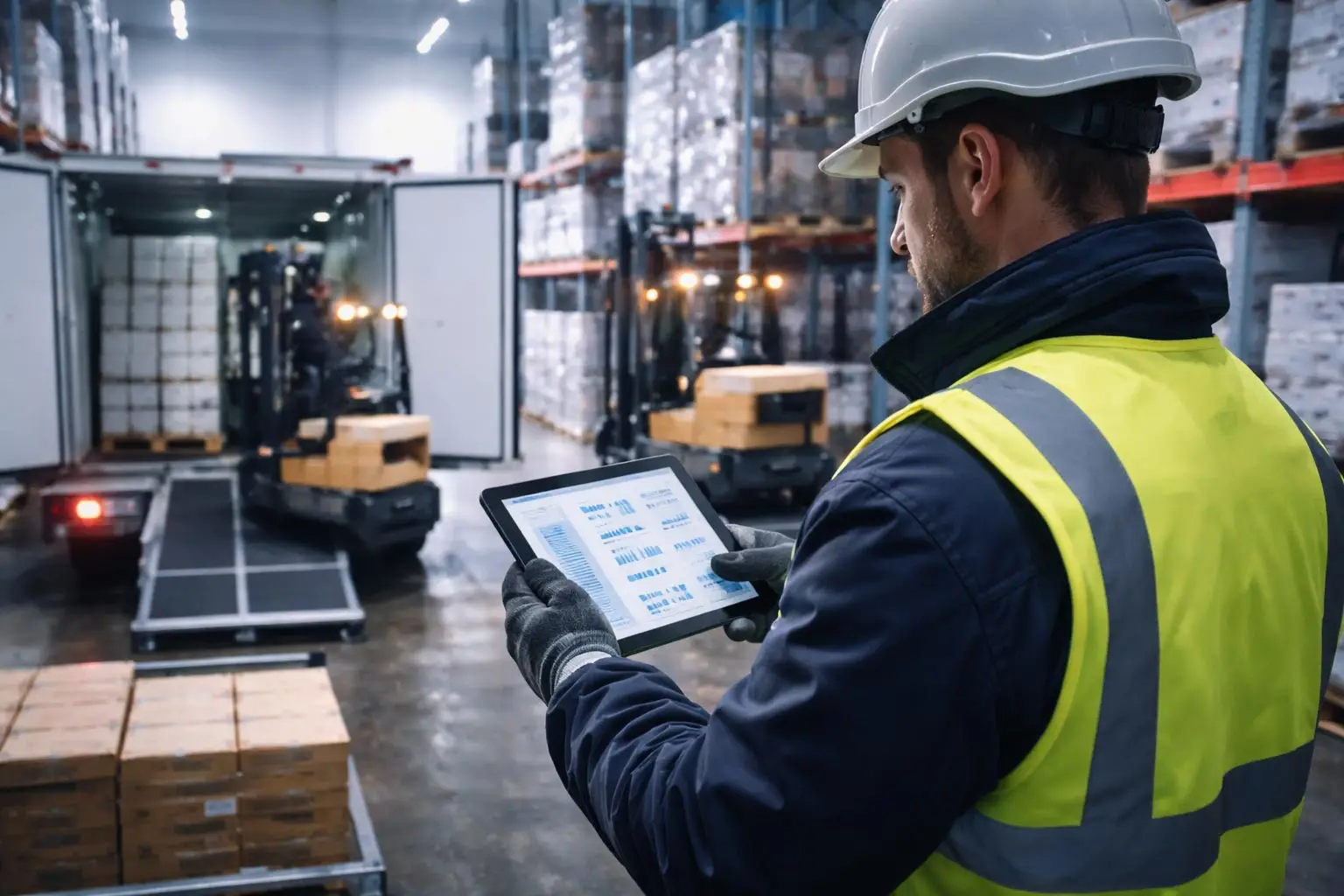

From a food logistics perspective, front-loading shipments in response to tariff risks can create bottlenecks at warehouses, require expanded cold storage capacity, and shift transport schedules in ways that ripple through domestic distribution networks. For businesses relying on a steady import rhythm, these distortions can mean tighter margins and a need for more agile supply planning.

At ACIT, we continue to monitor these macro-logistics trends closely. Despite the shifts in U.S. import patterns, our international food logistics operations remain stable, ensuring that clients receive consistent service and timely deliveries.